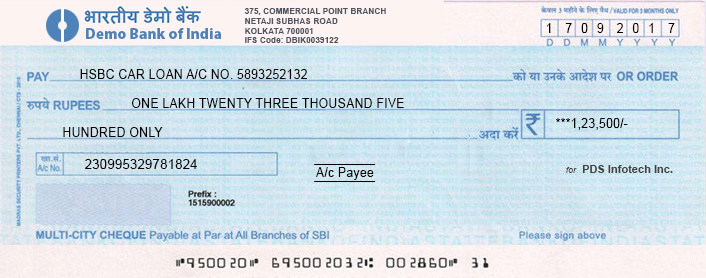

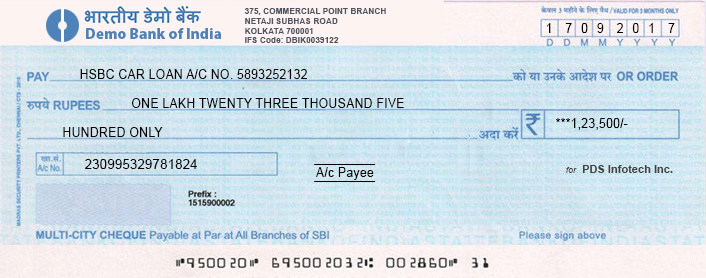

Negotiable Instrument - Cheque

Characteristic Features of a Cheque -

- A cheque is always drawn on a banker or in other words, the drawee of a cheque is always a bank.

- It is always payable on demand and does not require acceptance.

- Cheques may be payable to the drawer himself. It may be made payable to the bearer on demand unlike a bill or a note.

- The banker is liable only to the drawer. A holder has no remedy against the banker if a cheque is dishonoured.

- Cheques are exempted from payment of stamp duty, unlike certain classes of bills.

- A grace period of 3 days is allowed for a Bill. There is no such provision for a cheque.

- A cheque can be drawn where the drawer has a bank account.

- A cheque is valid only for three months from the date of the cheque.

Dishonour of Cheque

A cheque is said to be dishonoured, when it is not paid when demanded for

certain reasons.

Some of the reasons why a bank dishonours a cheque

- Where the drawer countermands payment or stops payment of the cheque

- When there are insufficient funds in the account

- When the customer has become insolvent or died and the bank has received suitable notice of the same.

- When the bank has received an attachment order from Government or Income Tax authorities or court and so on.

- Where there are material alterations on the cheque.

- Where the signatures of the drawer or endorses are irregular.

- When the drawer has closed his account prior to the presentation of cheque.

- When a cheque is mutilated

- With a view to prevent persons issuing cheques carelessly without maintaining balance in their accounts, Section 138 of NI Act provides for certain legal recourse to the holder of the cheque, if it is dishonoured due to insufficient funds.

Comments

Post a Comment

Message